We live in a country that is full of paradoxes. As a fintech investor, I see two sides of the spectrum every day. On one hand, there's an immense opportunity to penetrate a market starved for financial services (~$500B SME Credit Gap, only 50M credit card users, 4% insurance penetration). On the other hand, I’m inundated with calls from banks trying to sell me personal loans, insurance, or the next incremental product.

This disparity is quite concerning. Why can’t banks or any financial institution focus on acquiring and serving the underserved customers instead of repeatedly targeting the same pool?

The Real Problem: Data, Not Creditworthiness

The challenge isn't that the next 500–600 million people in India can't be given a loan—it's that their creditworthiness is unknown. Distribution is not a challenge either, with a bank/NBFC branch present in almost every town. The real problem is reliable data access to underwrite these customers.

Traditional methods of assessing risk rely heavily on credit histories, salary information and formal financial records, which a significant portion of the population lacks. But the same customer might be filing GST, have transactions in their bank account, investments in a mutual fund and have the ability to repay debt. We need a solution that can aggregate data across multiple sources and give financial institutions the ability to underwrite. This is where the Account Aggregator framework comes in.

Account Aggregator Framework Overview

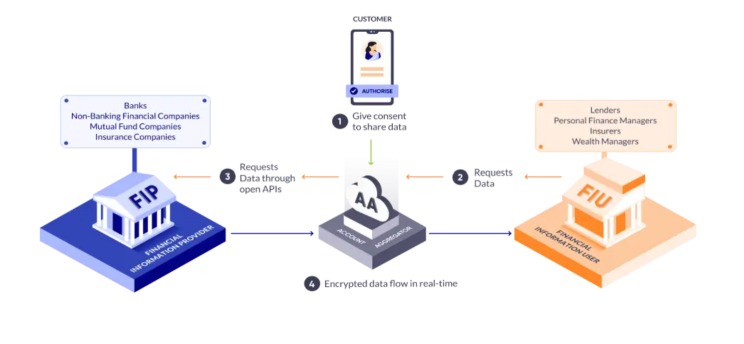

The AA framework enables businesses and individuals to securely share data from various sources (like bank statements, GST, Mutual funds) with financial institutions to avail their services. There are 4 key stakeholders within the AA ecosystem.

FIP (Financial Information Provider): The Institution that provides the customer data (Eg: bank account statements, mutual fund statements, GST)

FIU (Financial Information User): Institution that requests the data to understand the customer better and offer financial services.

AA (Account Aggregator): A licensed entity that securely transfers data between FIP and FIU without storing or accessing it.

TSP (Technology Service Provider): Enables the technical infrastructure for the FIP and the FIU to participate in the ecosystem. Typically helps orchestrate, analyze and derive insights from the data

Source: Sahamati

The building blocks of the AA infrastructure are in place today with 9 licensed AAs and 700+ institutions in various stages of becoming an FIP/FIU. Early use cases have also shown some promising results especially (a) early warning signals for collections, (b) customer onboarding without document uploads, (c) investment portfolio analysis for wealth advisors and so on

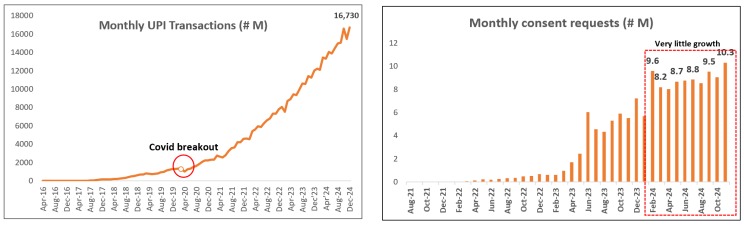

However, despite the integration of AA by various stakeholders, the adoption has not been a runaway success. The number of consent requests on AA have been stagnant at 8-9M for the last 6 months. Conversations with the industry also indicate that banks/NBFCs have enabled a few use cases but are not very eager to rapidly expand. Most seem to be in a wait and watch mode.

In contrast, other digital public goods like Aadhar, E-sign, UPI have shown significant adoption in the last 5-6 years. UPI especially has always been on the uptick, fueled by demonetization and Covid (Comparison chart of UPI v/s AA adoption below)

So what is the reason behind the slower adoption of AA? What can be done to improve this?

Source: data from NPCI, Sahamati

1. Whose data is it anyway?

Would any institution willingly give away their customer data to a competitor without even getting paid for it? Unless you are in a non-capitalist world, the answer to that question is always a NO.

This is the core problem behind the lack of adoption. Most banks have become FIPs within the AA ecosystem but are reluctant to actively participate, as they risk losing customers to better offerings. They have integrated with a TSP, made a few use cases live but have no real intention of scaling the initiative. It's more a tick-box solution for them.

The key point to emphasize here is that the data does not belong to the institution (FIP) at all but belongs to the customer. So sharing data should be a customer's right which every financial institution is obligated to provide with user consent.

2. Framework for FIP pricing

The AA framework does not have the concept of FIP pricing which means that the FIPs are not getting paid for sharing the customer data. This lack of incentive has prevented them from investing in tech infrastructure, hiring a team and adhering to any respectable SLAs. Many FIUs have raised concerns about downtime, data fidelity issues which can hamper the adoption of AA.

Based on conversations with the ecosystem participants, we know that there are active conversations on FIP pricing. Sahamati* is working with the industry to develop a pricing framework. Challenging as it may be, the need of this framework cannot be emphasized enough as it will be crucial to ensure FIP participation and accountability

(*Sahamati is a non-profit entity that has developed the AA framework and is working with the network participants to help with the adoption)

3. Data governance by FIUs

The data once shared with the FIUs can be used for various purposes. While there is a consent mechanism in place and rules clearly defined as to what the data can be used for, there is no method to monitor the actual usage. Many customers get calls for cross-selling / up-selling while the consent given was for an entirely different product. This has caused concerns among the network participants

Sahamati has come up with detailed purpose codes which define various use cases and specific data that can be accessed for each. However, there is opportunity for a startup to build monitoring mechanisms to ensure adherence.

Road Ahead

There are some active conversations that Sahamati is having with network participants to work on the pricing and data governance issues. While tricky, these problems can be solved with a few iterations and technology build. However, the key problem around FIP reluctance to share data needs to be addressed.

Going back to the reason why UPI succeeded - along with factors like demonetization and Covid that definitely played a role, I believe that the role of NPCI has been crucial, especially onboarding banks onto the network. This is precisely what the Account Aggregator framework needs—a central governing body that not only establishes the framework but also actively oversees and drives the ecosystem's growth, ensuring full participation and accountability. Currently, Sahamati operates as a voluntary organization and is not under the direct purview of a regulator. To unlock the full potential of the AA framework, Sahamati—or a similar entity—must be empowered with regulatory authority and structured akin to NPCI. This would provide the necessary governance, enforce accountability, and create a transparent and equitable ecosystem that fosters trust and adoption.

Another lever that can be definitely useful is creating customer awareness through campaigns similar to “Mutual Fund Sahi Hai” to ensure that customers demand data sharing mechanisms from their FIPs. Nothing works better than when a customer demands a service provider for a viable and easy to use solution.

Conclusion

The Account Aggregator framework is all set to bridge the financial inclusion gap, but it requires the collective effort of regulators, financial institutions, technology innovators, and customers.

- Regulators and policymakers: Empower governing bodies like Sahamati with regulatory authority to drive adoption and enforce accountability.

- Financial institutions: Embrace AA as a strategic opportunity to tap into underserved markets and invest in the necessary infrastructure.

- Startups and tech providers: Develop technology to help AA adoption, enhance data governance, and build groundbreaking use cases

- Customers: Demand data-sharing mechanisms from your financial service providers to access better financial products and services.

Here’s wishing 2025 will bring a whole lot of innovation, customer awareness, policy enhancements and adoption to this ecosystem and pave the wave for financial inclusion.

Views expressed in the article are personal

(If you are a founder building on AA / just an enthusiast wanting to understand the space, do reach out to me at shivani@primevp.in)