You are the CEO/co-founder of a hot SaaS company, and have just got a term sheet at a $100M valuation. You are over the moon; you were thinking $50-60M valuation and this is beyond what you were expecting in your wildest dreams. Competing term sheets has quickly moved the valuation up and this couldn’t be better. It is also 2021.

Fast forward two years and you are in a dilemma. Going after 3x growth as your Northstar, duly egged on by the board, has led to inefficient marketing spends and you are left with a 12 month runway. You want to raise a round to extend your runway before it is too late. There are a couple of VCs interested, but there's a catch. Valuation on offer is $50M. What should you do?

This is an increasingly common conundrum founders are finding themselves in as 2023 rolls along and the valuation resets which at first appeared temporary become the new benchmark.

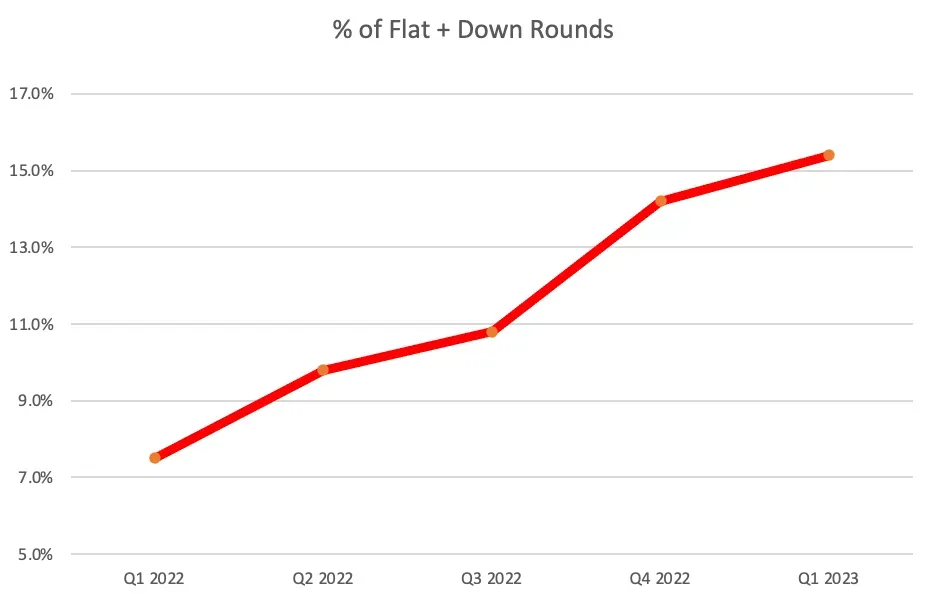

Down rounds are undesirable, but are they are not as uncommon as founders might think. Per a recent Pitchbook venture capital report, startup valuations in US are down ~60% YoY in early stages and flat or down rounds comprise ~15% of all such rounds. If the valuation trajectory holds we will see this percentage increase further.

Source: Pitchbook, Geography: US

Why founders and investors alike hate down rounds are easy to fathom. Founders don’t want down rounds as it send a weak signal to the company employees about the state of the company. They can also be extra dilutive if anti-dilution clauses kick-in. Anti-dilution is a clause in investor agreements that grants extra equity to those investors who participated at a higher valuation than the current round. Existing investors might be reluctant to broach the topic as it causes them to ‘mark down’ the valuations of the company in their books. In other words, down rounds are unpleasant for all stakeholders.

But keeping the valuation high and deferring fund raise can put the company at an even greater risk. As the cash runway for the company reduces, the founders' ability to negotiate with any new investor is significantly impacted. Under pressure to increase runway, founders are forced down a path of successive rounds of head count cuts.

So, how should one think about down rounds?

Getting capital into the company at the right time is the most important consideration for founders, even if it means taking a down round

Paradoxically, despite being a bitter pill, after the funding is complete, a down round can serve to relieve pressure on the founders. By resetting the valuation to a more realistic level, the company is not under any pressure to ‘justify' its valuation or to 'grow into its valuation’ as soon as possible.

A realistic valuation also makes the company more investible by external investors, who can focus on understanding and valuing the business on fundamentals instead of being turned off by the sticker price

With lower competitive intensity that typically accompanies down cycles, founders can build the company at a more measured pace with efficient marketing spends. And investors, while forced to mark down the company as a one time activity, can focus on helping the founders with company building vs having endless discussions on valuations.

One way to mitigate the dilution impact on founders is for them to discuss incremental equity grants with the board upon hitting company targets. This helps the founders and also aligns investor interests with a focus on value creation.

Can down rounds be avoided altogether? Unlikely.

We are all familiar and comfortable with public market share prices going up and down. Private markets do not have the constant price discovery that accompanies a publicly listed company, but are subject to similar laws of supply and demand

It should not be surprising then to occasionally see periods where valuations come sharply down. Public SaaS multiples for example are down over 50% over the last year. It is no surprise that private SaaS multiples have also taken a hit.

There is, however, one measure that can help mitigate the impact of and potentially reduce the chance of down rounds.

It is counter intuitive, but the highest valuation at a round is not always the optimal strategy

An investor offering the highest valuation, like in the opening example, should not be an automatic first choice for founders. A realistic valuation, while more dilutive in the short term, can be both healthy and less dilutive over the long term. What might be a down round in one case can be a flat-round or a slightly up round if the previous round valuations were lower. Founders are also likely getting a higher quality investor, who has done a deeper analysis of the business and will not insist on growth at all costs to justify their entry valuations.

Valuation ultimately is entirely a function of supply and demand in private markets. In frothy times, capital is in ample supply and driving up private market valuations. In frosty times, capital is scarce and an ample supply of quality startups seeking it. Founders will do well to accept down rounds as an inevitable part of capital markets instead of worrying about the optics around them.

In Summary:

- Down rounds are not uniformly bad for the company. It is more important to get capital into the company in a timely fashion than worrying about the optics of a down round

- Working with the board, management can establish incremental grants on hitting growth targets that both reduce the impact of dilution for the founders and add enterprise value for investors

- It is prudent to not jump at the highest valuation offer when raising funds. It has consequences down the road, especially when valuations multiples in the industry change

Shripati Acharya is co-founder & Managing Partner at Prime Venture Partners, an early stage VC firm based out of Bangalore, India. He tweets as @shripati. Prime invests in category creating, early stage companies founded by rock star teams