“The battle between every startup and the incumbent comes down to whether the startup gets distribution before the incumbent gets innovation”

- Alex Rampell, General partner @ a16z

In Generative AI. where it is the incumbents that are the innovators. How does a startup compete?

This is a key question as we hurtle down the Generative AI path. There is little doubt the rise of Generative AI is every bit as significant an inflection point as the introduction of iPhone in June 2007. Just as mobile is integral to every piece of software today, Generative AI will be core to practically all software we use. And this transition will be quick, it will unfold in the next 18-24 months.

Historically, whenever new platforms have burst into the tech landscape, startups have benefited by disrupting slow moving incumbents. This was true for the Internet in the mid nineties, cloud in 2000s and mobile in 2007 (with the first iPhone launch). This time promises to be different. Incumbents are moving fast to release products on their own application stack, benefiting from highly modularized interfaces to LLMs and a powerful open source tools. Coupled with large distribution and deep relationships, incumbents are on a very strong wicket.

The question for entrepreneurs and VCs alike is where is the white space for startups to emerge when incumbents already have a huge lead?

While Generative AI is moving at a rapid pace, there are a few things we can predict with high degree of certainty

- All existing B2B SaaS software will have a Generative AI add-on/co-pilot/assistant. Many consumer facing apps will integrate co-pilot as well but we are not discussing that here.

- At a minimum this will provide a more intuitive chat interface to the product instead of having the user navigate a complex UI. It will more likely provide a comprehensive reasoning and logic layer to the underlying customer data relevant to the product.

- Existing vendors will be in the best position to create and distribute such a co-pilot. In other words, existing vendors will be able to quickly provide a basic Gen AI layer and can add more functionality down the line. This is because Gen AI is so modular and powerful that this layer can be very thin and developed quickly. As such, incumbents will be able to create and launch add-ons in short order

- As a result we should expect the following products to be market leaders in their areas;

- Co-pilot for SalesForce to be provided by Salesforce (Einstein)

- Marketing Automation on Hubspot by Hubspot (Chatspot with AI)

- Image manipulation on Adobe Photoshop & Illustrator by Adobe (based on Firefly, Sensei)

- Document editing by Microsoft on Microsoft 360 and Google on Gdocs

- Analytics and Business Intelligence software on Excel and Gsheets by Microsoft and Google

Note that there are some new players that have gained early traction, such as Jasper.ai on document creation. But I expect stiff competition from Microsoft Word and Gdoc co-pilots, and their superior distribution and native integration muscling out Jasper over time into being a fringe player.

So where is the opportunity for a new entrant? It will be in creating native Gen AI applications in white spaces where there are no obvious market leaders.

Opportunity set will vary depending on where you want to operate on the Gen AI stack.

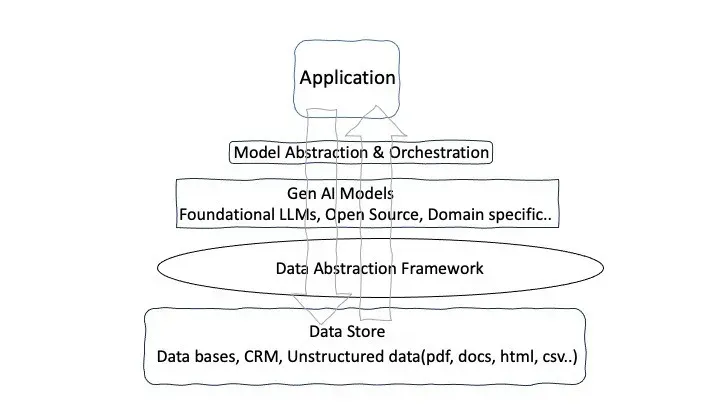

Enterprise apps will sit on top of a 4 layer foundational stack. The bottom layer will be data-stores such as CRM, Databases and unstructured data repositories (such as pdfs, docs, power points). A data coordination layer above that to abstract the various data interfaces. A LLM layer for logic and reasoning which might consist of multiple Gen AI models and an orchestration layer to work with the various models.

The opportunities at foundational and infrastructure level will look very different than the application layer. Open source should play a major role in both of these layers. Startups with business models that add value on top of open-source (such as cloud hosting, enterprise support, customization), much like Redhat, will be successful here.

At the application level, value will be captured by applications solving specific vertical use cases

The axes along which vertical apps can add value are:

- Workflow integration tailored to the enterprise with native integration for existing enterprise application stack

- User Interface specific to the application context

- Fine tuning of data models using specific data private to the enterprise. With inference constrained in scope to reduce hallucinations

- Data privacy and security of enterprise data (both customer and usage data)

- Flexibility of hosting models, including on-prem deployments were required

- Proprietary data that startup can bring to their inference engine which is highly relevant to the vertical use case

- Cost optimized with models that minimize cloud costs

The key here will be identifying such white spaces, and approaching them with a native Gen-AI solution lens. The SaaS world will see a new generation of solutions adding a massive leap in productivity, and with it new opportunities to build significant companies.

If you are building a company in enterprise SaaS, we’d like to hear from you. Reach out to any of us at Prime’s investment team via LinkedIn or Twitter.

Shripati Acharya is co-founder & Managing Partner at Prime Venture Partners, an early stage VC firm based out of Bangalore, India. He tweets as @shripati. Prime invests in category creating, early stage companies founded by rock star teams