There is an good twitter thread that prompted this blog post.

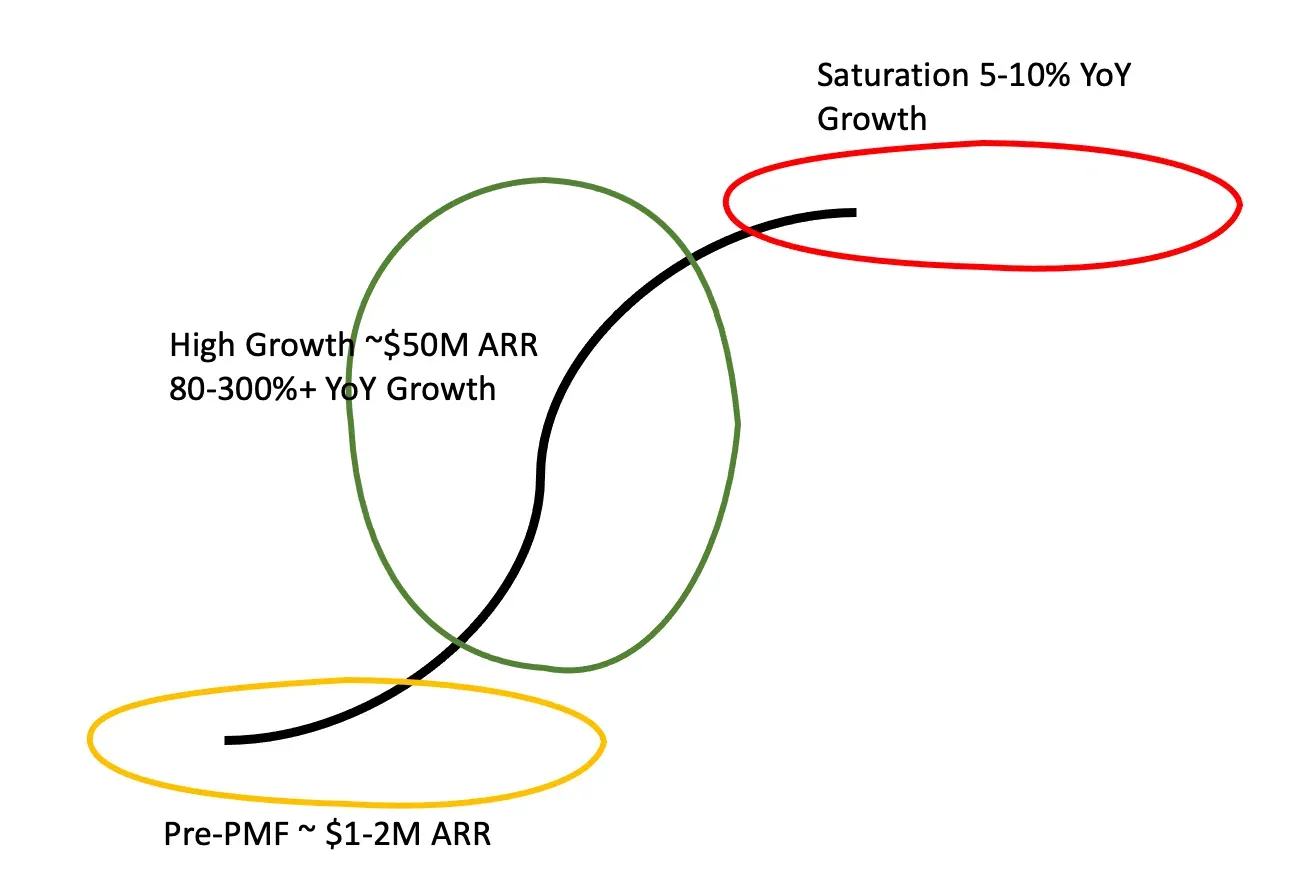

We are all familiar with the S curve life cycle of successful products. In a SaaS context, this would be an initial pre-Product Market Fit (PMF) phase where the company is focused on customer discovery and business model fit. The duration of this phase can be as short as a few months to a few years until the product attains PMF.

The second phase is the most exciting and heady phase. The product has clear PMF, customers like it, there is a lot of headroom for differentiation and innovation and all problems are good problems stemming from high growth - ramping teams in onboarding, training, customer success and such.

What happens when this growth stalls? All products go through a stage where the growth taps out

This could be for a variety of reasons : the market size is saturated, bigger players have entered the market in a significant way dramatically increasing competitive intensity, new technology transitions - such as Gen-AI - are creating a big dislocation, or even regulatory changes that alter the market. These are the doldrums - growth is down to single digits, no foreseeable tailwinds, and the investors, market and employees have lost interest in the story.

For founders this is uncharted territory. Slow growth was reserved for the incumbents they displaced, not something they faced. They are used to being role models for their peers, their investors and their employees. Having to defend a ‘high growth’ story, when the growth is down to 10% or less, is stressful and ultimately untenable.

What’s the way out?

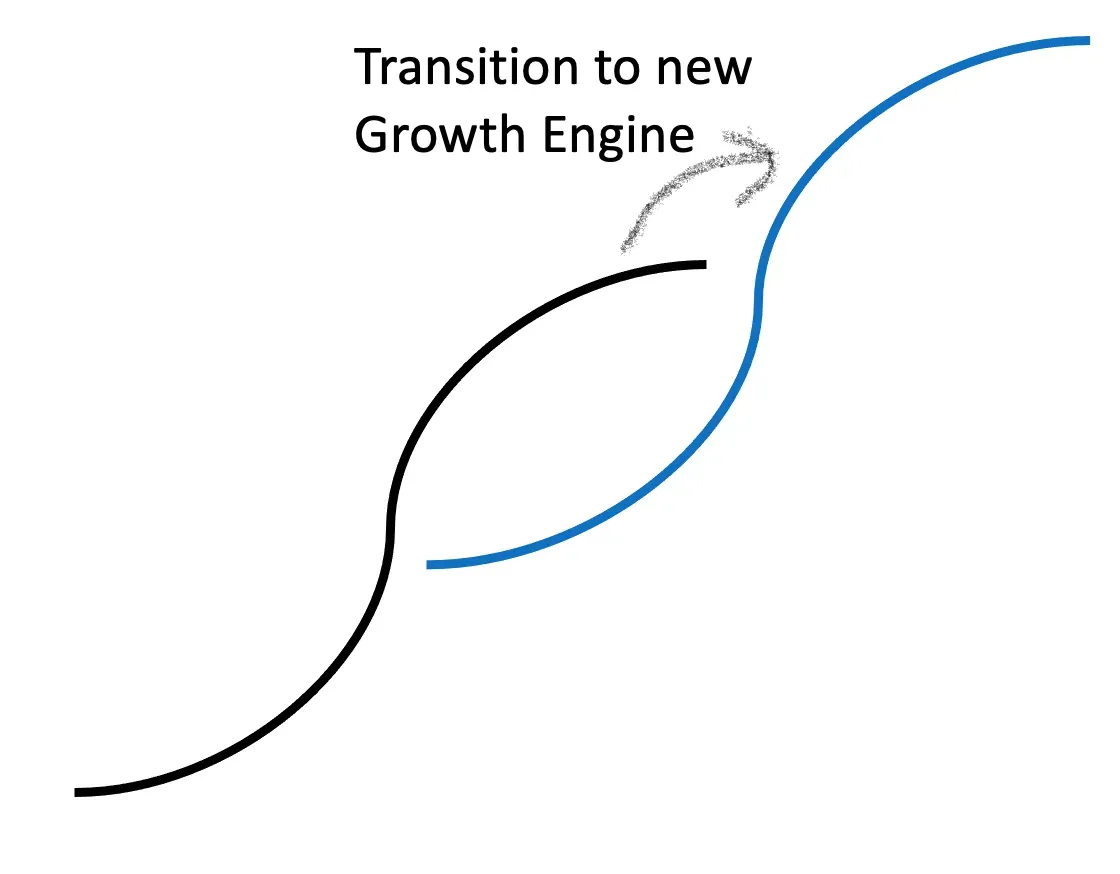

The solution is to have a new S curve to ride once the initial one flattens. In order to have the luxury of a new growth engine, however, companies have to lay the seeds of getting out of this dilemma long before they encounter it.

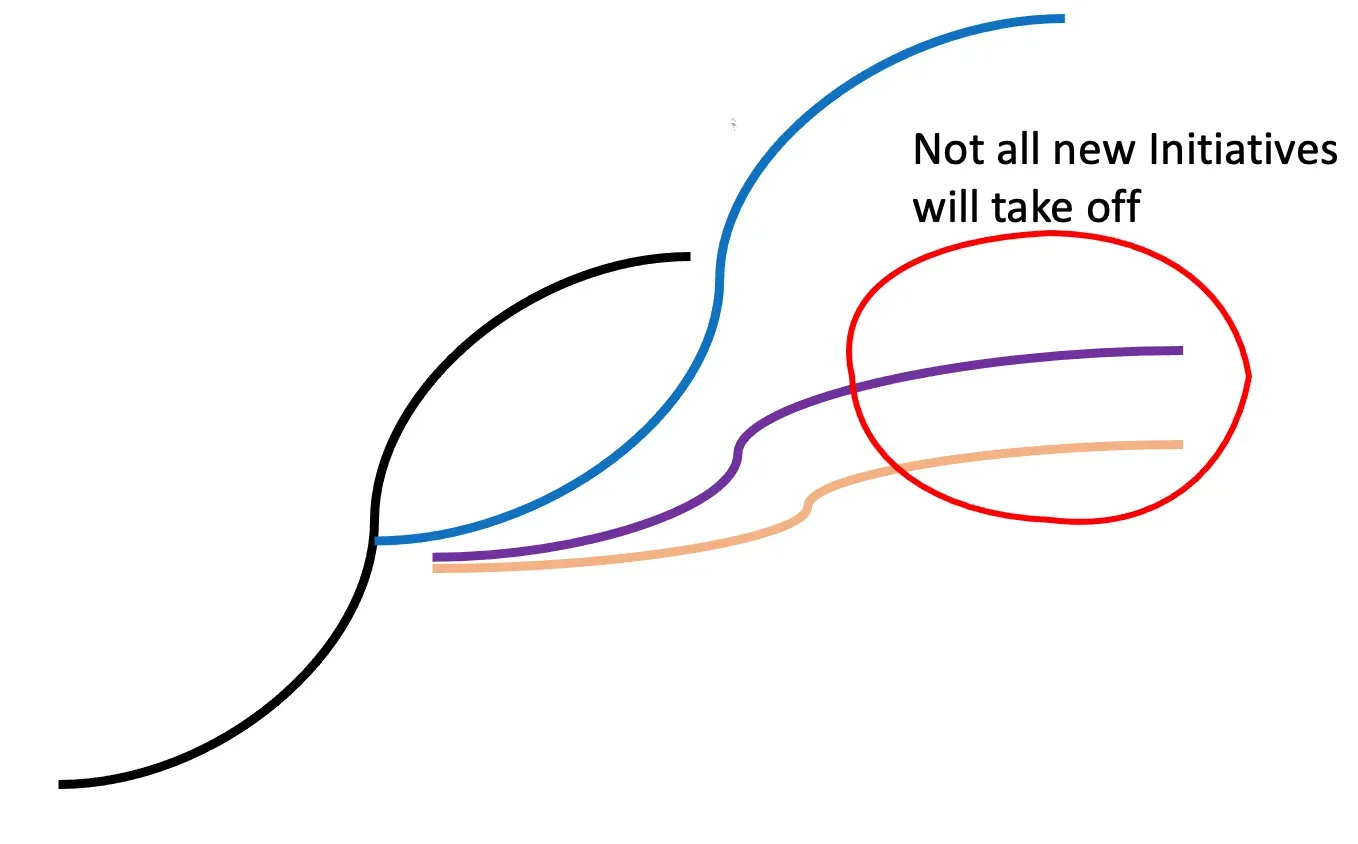

New initiatives can come in different shapes - products in adjacent markets, entering new geographies (which typically involves evolving the solution and GTM to new geographies), adding new product lines that address fresh problems to the same customer segment or entirely new segments where the company has deep insights.

These new initiatives have to be set in motion precisely at the time it is most inconvenient to start them

This is when the primary product is in growth mode and is garnering all the attention and resources in the company and taking anything away from that feels wrong.

Carving space for new initiatives, If you take any standard financial metric - expected return, DCF, marginal return on investment - will fail. It would make no sense to invest in new initiatives because every dollar invested in an already successful product is going to yield higher returns. The only way you can justify this resource allocation, or distraction, is visualizing the tapping out of what appears to be a growth engine with no end in sight.

By the time it is obvious the primary growth engine is stalling, it is too late to do anything about it

Every initiative will need an initial phase of iterations and market validation before it can yield results. And starting new initiatives with a short timeline to start making visible impact to a medium sized company’s top line, is a futile exercise. The talent pool at this point is already looking outside, investors are eager to get out, and there is little patience to invest in what now appears to be a ‘turn around’.

In the Indian SaaS context, where companies are focused on Indian enterprise customers, this tapping out might come as early as $25-30 M ARR. For global SaaS, this might be in $50M+ stage.

Kicking off new initiatives comes more naturally to product oriented founders. Because they are driven by the excitement of product innovation. They also instinctively know that the pre-PMF phase is the hardest for any product, which requires enormous patience, with a high mortality rate. Yet that is the only way to discover new growth engines.

Sales and marketing driven companies, where financial consideration takes center stage in budget allocations, tend to stumble here.

It is not that sales focused founders cannot steer an engine for continuous innovation, but in order to do that, they would need to fundamentally change the way they look at resource allocations in the high growth phase. They will need to abandon the vocabulary of DCF and the instinct to pour over elaborate spreadsheets for decision making

Instead the focus has to be on investing in innovation which do not provide any near term returns, but show high promise in the event they succeed.

Having a continuous cycle of introducing new innovations, pruning the ones that are not middling and nurturing those that show promise, nurtures the innovation cycle that lead to new S curves to transition into, in due course.

The seeds for that, however, need to be sown when you least want to think about them.

Which tech companies in your experience, have navigated such a transition in recent times?

Shripati Acharya is co-founder & Managing Partner at Prime Venture Partners, an early stage VC firm based out of Bangalore, India. He tweets as @shripati. Prime invests in category creating, early stage companies founded by rock star teams